Find out more

Qualification structure

The ADIT qualification is a highly respected international tax learning programme, with students in over 120 countries worldwide. Designed by world-leading experts, it is a challenging and rigorous qualification that will reward you and your career.

Becoming ADIT-qualified is a great way of demonstrating your dedication to your career, and highlighting your technical expertise to help you stand out from the crowd.

How is the qualification structured?

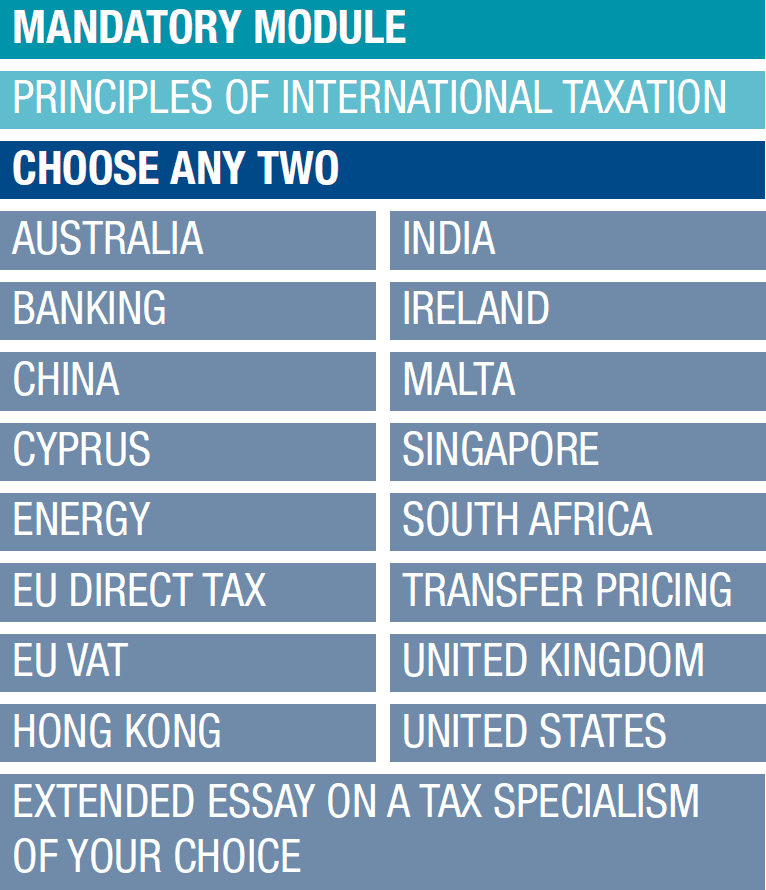

The ADIT qualification has a modular structure. To achieve qualification, you will study and pass three modules covering different aspects of international tax. The qualification has been designed to be as flexible as possible, so that you can find what you need in your studies to help you in your role.

How long does it take?

The time it takes to complete the qualification varies, depending on different factors such as your level of experience with international tax and your confidence with the materials, so while we don’t prescribe a set amount of time, we suggest the following:

- Achieve the qualification

Registration is valid for five years, but most students will complete the qualification within three years depending on their circumstances. - Manage your exams

All modules are examined each year, around the world. The most popular modules are available twice a year. You can take exams one at a time, or sit all three in the same session, whatever suits you best. - Study and prepare

As a rough guide, we suggest that the study time needed will be around 140 hours for the Principles of International Taxation module, and 200 hours each for the option modules. This does vary, and you may find you need more time to prepare in areas you’re less familiar with.

How it works for you

- Flexibility

Designed to be as flexible as possible, so that you can fit your studies around your job. Sit your exams in the way that best suits you. - Practical application

The exams focus on the real-life application of international tax principles, as well as theory, blending academic rigour with professional skills. - Global syllabus

Modules covering a range of international tax topics, so that you can tailor your learning to suit you and your career.

What you need to do

- Choose your study method

There are study options to suit everyone, from classroom learning to self-study. Whatever your preference, you’ll find a method that works for you. - Register as a student

To start, you’ll need to register as an ADIT student. It will usually take up to ten working days for your application to be reviewed and approved. - Enter for your exam

Once your registration has been approved, you can start entering for exams. - Complete the three modules

Study and pass three modules to complete the qualification and become ADIT-qualified. Once you’ve completed, you will be eligible to join us as an International Tax Affiliate.

Important: You must submit your student registration and exam entry forms yourself, as course providers or employers cannot do this on your behalf.