Qualification structure

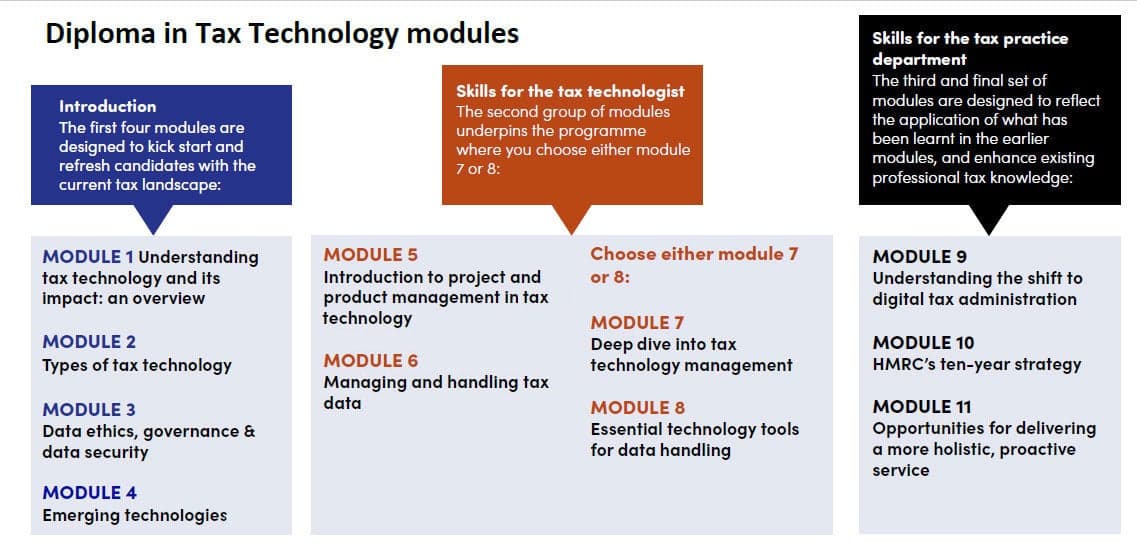

In order to register you will need to choose the route that best suits your knowledge requirements. The DITT is made up of 9 compulsory modules, and then depending on the route you select a further module of your choice.

Route 1 module: Deep dive into tax technology management

If you are a tax professional who predominantly manages tax technology projects and would like to know more about systems and processes in tax technology, then this is the route we recommend.

OR

Route 2 module: Essential technology tools for data handling

If you are a tax professional who would like to understand more technical details to help deal with data, such as data engineering and data analytics, then this is the route we recommend.

Diploma updates

The Diploma is updated on an annual basis; the most recent syllabus update was implemented in July 2025. If you are part way through a module at the time of a syllabus update, you will need to start the module again as it may have changed. When an annual update is scheduled, you will receive email communications from the Education Team with sufficient time to complete your current module before the update.

How long does the DITT take to complete?

You can complete the DITT in 60-90 hours; completion time will vary by pre-existing knowledge level. You choose the pace and study at a time that suits you. Your registration allows three years for you to complete it, for example, if you pass some modules but then must take a study break before continuing. If you have not completed the DITT within three years of your registration starting, then any module passes you do have will expire and you cannot re-register.

Find out more about how it works here.