Useful links

India option module

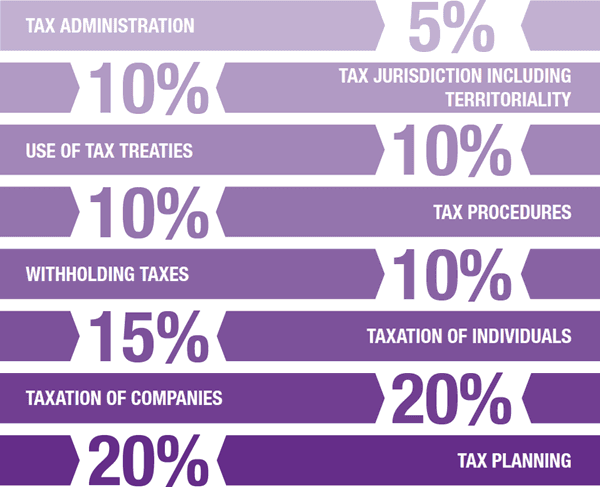

This module gives you the required knowledge, skills and understanding of international tax issues relating to Indian businesses that you need to succeed in your career. Your learning will cover in detail the Indian tax system in an international context, with particular emphasis on Income Tax, tax jurisdiction including territoriality, taxation of individuals and companies, and the use of tax treaties.

Who is it for?

The India option module is aimed at professionals around the world, particularly to tax advisers, lawyers, inhouse tax professionals and those advising or working with multinational corporations. ADIT is suitable for senior level professionals, managers or those working towards a senior level.

What does it cover?

The exam consists of three parts. Part A consists of two mandatory questions worth 25 marks each. Part B consists of two questions worth 20 marks each, of which candidates are required to answer one. Part C consists of five questions worth 15 marks each, of which candidates are required to answer any two.

- Exam length: 3hrs 15mins

- Available in June

How it will benefit you

- Gain a robust understanding of theory coupled with practical application

- Build your confidence, skills and competencies to apply principles in your daily work

- Keep up with fast-changing developments in tax law, and stay ahead in your field

- Increase your employability with a qualification recognised around the world

Length of study

Approximately 200 hours of learning time is recommended to complete the India option module. This may vary dependent on a number of factors including your background, knowledge and experience, and your study method.

How is it assessed?

- One exam consisting of three parts

- Questions designed to test your application of concepts to real world scenarios

- Employer-driven syllabus, with a professional focus