Useful links

Banking option module

This module gives you the required knowledge, skills and understanding of current tax issues to banking activities and financial instruments within an international context that you need to succeed in your career. Your learning will cover in detail investment banking, capital markets, global markets, asset financing, asset management, private banking and wealth management.

Who is it for?

The Banking option module is aimed at international tax professionals working across the financial service sector. ADIT is suitable for senior level professionals, managers or those working towards a senior level.

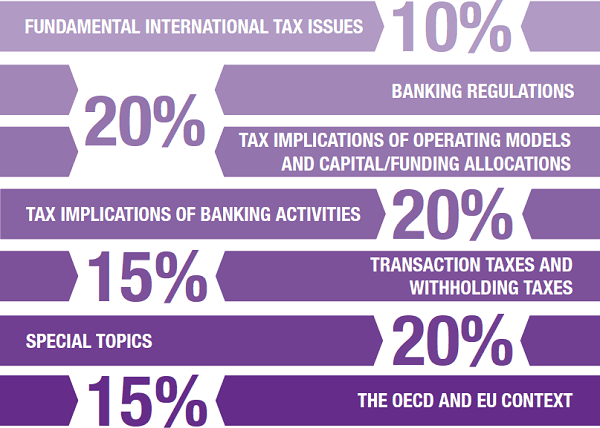

What does it cover?

The exam consists of three parts. Part A consists of two mandatory questions worth 25 marks each. Part B consists of two questions worth 20 marks each, of which candidates are required to answer one. Part C consists of four questions worth 15 marks each, of which candidates are required to answer any two.

- Exam length: 3hrs 15mins

- Available in June

How it will benefit you

- Gain a robust understanding of theory coupled with practical application

- Build your confidence, skills and competencies to apply principles in your daily work

- Keep up with fast-changing developments in tax law, and stay ahead in your field

- Increase your employability with a qualification recognised around the world

Length of study

The Banking option module is aimed at international tax professionals working across the financial service sector. ADIT is suitable for senior level professionals, managers or those working towards a senior level.hod.

How is it assessed?

- One exam consisting of three parts

- Questions designed to test your application of concepts to real world scenarios

- Employer-driven syllabus, with a professional focus