CTA programmes

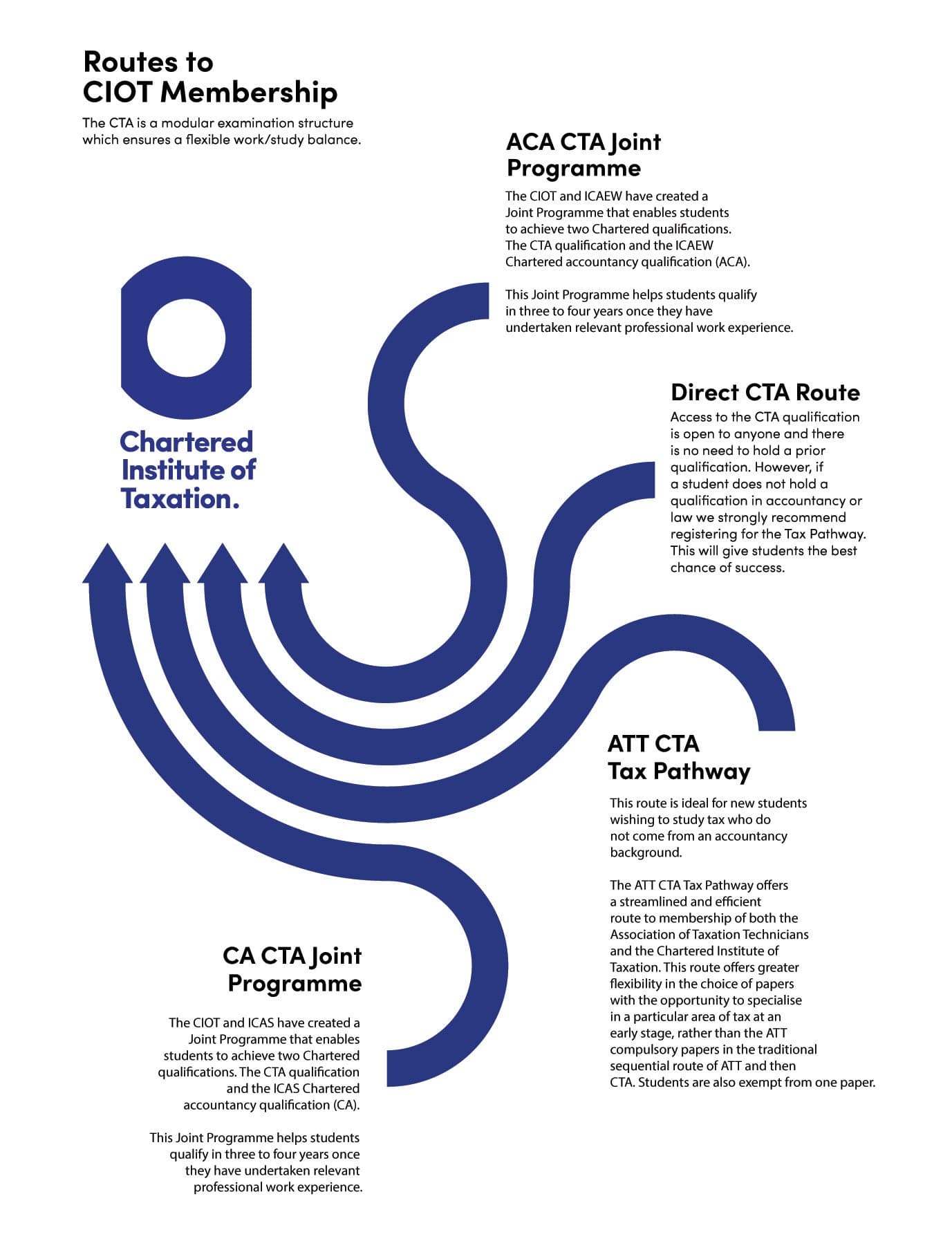

There are a number of routes employees can take to earn the prestigious CTA (Chartered Tax Adviser) qualification.

These include:

The standard CTA route:

Your employees can study the CTA as a stand-alone qualification. This is not recommended for anyone who doesn’t have professional experience in taxation.

The ATT CTA Tax Pathway

Your employees can achieve the ATT (Association of Taxation Technicians) and CTA qualifications.

The ACA CTA Joint Programme

Your employees can qualify as Chartered Accountants and Chartered Tax Advisers.

The CA and CTA Joint Programme

Your employees can fast track their CA and CTA studies and achieve their designatory letters in three or three and a half years.

The Level 7 Apprenticeship

This employer-designed standard is another popular route to becoming a CTA. It is equivalent to a Masters’ level qualification (although it is not a Master’s degree).

Click here for a guide on how to achieve these CTA qualifications and information on fees and timetables.

To sponsor an employee for the CTA qualification, register here.