House of Lords Inquiry: IHT changes create big risks for executors, warn experts

Leading practitioners in estate law have told peers that becoming a personal representative (executor) of an estate could become unmanageable, deterring people from taking on the role.

The warning was given at a session of the House of Lords Finance Bill Sub-Committee on 20 October 2025 to scrutinise the draft Finance Bill’s provisions on inheritance tax (IHT) relating to the inheriting of unused pension pots.

A personal representative of an estate, also known as an executor or administrator, is legally responsible for managing and distributing the deceased person's assets according to their will (where one exists) and national laws. The role includes tasks such as notifying beneficiaries, paying debts and filing necessary legal documents.

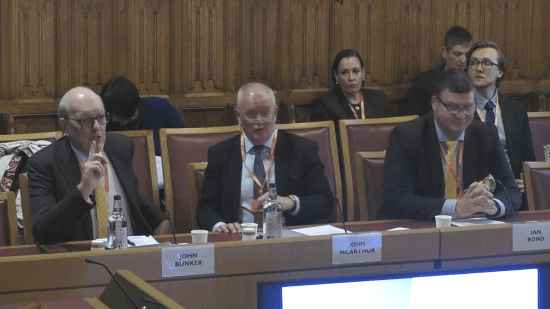

This session brought together a panel of leading practitioners in this area:

- Ian Bond, a solicitor for Dignity Legal Services, representing the Law Society of England and Wales

- John Bunker, a solicitor and chartered tax adviser with Irwin Mitchell, representing the Chartered Institute of Taxation

- John McArthur, a solicitor with Gillespie Macandrew in Edinburgh representing the Society of Trust and Estate Practitioners (STEP)

- Annie Pearson, representing the Law Society of Scotland

Burden on Personal Representatives

The session opened with the Chair inviting the panel to summarise their concerns about the burden the Bill would place on personal representatives (PRs) when estates include relevant pensions.

John Bunker set the tone, warning that “the only way that the current rules could work is if the PRs of an estate, if they are liable for tax on something they do not control, hold on to the whole assets of the estate until they have clearance and nothing is distributed, because otherwise they could be liable for tax on an asset that they do not control and it is outside their hands.” He warned of the risk that “becoming a PR becomes unmanageable, because the risk is unknown, and executors will renounce probate because they cannot get involved.”

Bunker further highlighted the professional risks: “Once you get involved in doing anything, like inquiring into what the assets are, you have intermeddled in the estate and you cannot then renounce. Therefore, professional indemnity cover will become a huge problem. The premiums are likely to go up significantly and the burdens may get so much that many professionals will stop doing the work entirely.” The result, he warned, would be “the loss of tax revenue, there will be delays in getting the tax and they will have the extra burden of dealing with lay people… where there is no professional to act as an executor.”

John McArthur agreed, adding, “The risk under the proposal seems to be all on the personal representatives, the executors, not on the pension scheme administrators. That is a big issue for executors and personal representatives.” Ian Bond echoed these concerns, stating, “Personal representatives being liable for inheritance tax on the unused pensions when they do not control the asset will put a lot of people off wanting to be professional personal representatives or professional executors named in wills.”

Annie Pearson said the Law Society of Scotland’s main concerns are two-fold: “the additional administrative burden on the personal representatives and the difficulty of balancing competing interests of estate beneficiaries versus pension beneficiaries, which will make the role of personal representative extremely unattractive.”

Advisers and Information Sharing

Lord Leigh of Hurley asked about the implications for solicitors and professionals acting as advisers to PRs. Bunker responded, “There is still a problem for professionals in acting for a lay PR, because the PRs will expect you to guide them and the responsibility will be on you as a professional adviser.” McArthur added, “Advisers will be reluctant to say that it is okay to distribute unless they are absolutely clear that there is no additional IHT liability about to come out of the woodwork. It therefore becomes virtually impossible to complete the administration of the estate, which impacts on beneficiaries, who are going through a grieving process anyway.”

Bond noted the practical difficulties: “You sometimes have conversations as a solicitor advising clients who are appointed by virtue of the intestacy rule to be the personal representative for someone who has passed away, and you have to explain to them that they are in a fiduciary position… This puts us in a situation where we will have to explain a lot more, so that the clients understand that it is not just the assets in the estate but also the pension.”

On the six-month deadline for information sharing, McArthur explained, “Six months is quite a short period of time to bring everything together. The experience with PSAs [pension scheme administrators] is mixed, in the information that we get. Information-sharing powers will help, but nevertheless there is a big learning curve to be put on PSAs to deal with this.”

Paying IHT from Estate Assets

Baroness Fairhead queried the government’s suggestion that PRs should pay pension-related IHT from estate assets and reclaim it from beneficiaries. Bond described the complexity: “You may have an estate going to a different set of beneficiaries from those receiving the pension, and people very rarely die tidily… You now have to start looking for and collecting the assets and liabilities from the estate. At the same time, you are making all the enquiries about pensions, and there could be lots of pensions that you have to go back and have a look at. The onus is on the personal representatives to go and look for this information.”

Bond also highlighted the circularity of authority: “Most of the time when we contact pensions for information, they will say, ‘Come back when you have the authority; you need a grant to talk to us’. They want us to have the authority. We cannot get the authority because we do not have the pension information, so we go around in a little circle of not getting things done completely.”

Bunker pointed to the impact of recent reforms: “Ten years ago, the whole law and tax here was totally reformed by George Osborne when he was Chancellor. That opened up opportunities and arrangements which have meant that, for 10 years, people have been doing things in a particular way… We now have to rethink all of that because the tax has completely changed.”

Mitigating Actions and Practical Solutions

On mitigating actions for split beneficiary cases, McArthur suggested, “One mitigating factor would be to have the pension scheme responsible for its own tax, because then the risk of non-payment of inheritance tax moves from the PRs to the scheme administrator.” Bunker proposed, “The PSAs might retain 50% of the pension pot as a matter of course until there is clearance about whether it will go to an exempt spouse or whatever.”

Bond warned of “a growing market for inheritance tax loans; there is a pension pot with a large tax bill due and the estate does not have the assets to pay it, so they will be looking for open-market loans with interest and charges that go with that.”

Legislative Changes and Consultation

Baroness Bowles asked whether there was time for legislative changes. McArthur replied, “One of the problems with inheritance tax is the ripple effect of any changes… That needs to change to help the executors.” Bond suggested, “The one thing that Parliament can do is take that six months and make it 12 months to give more time, or even say that the tax due on the pension is not payable until after the grant of probate, or six months after the date on which the grant of probate is issued.”

On the government’s consultation, Bunker said it would have been helpful to have had more time. Pearson said that the consultation put out in January 2025 was extremely narrow: “It was very technical and focused purely on how the new proposals would affect trusts. There was not really any consultation on how it would affect business owners and farmers more generally.”

Concluding Observations

The panel concluded with warnings about the practicalities of the proposals. Bunker stated, “The suggestion that pension money could go out to beneficiaries and then be reclaimed is unrealistic and does not represent the real world in terms of people spending money and it still being available.” He also stressed the need for “the confidence that, when they have a certificate of discharge from HMRC, that is the end of their liability.”

The session closed with the Chair thanking the witnesses for their “extremely helpful” contributions, noting that “there is plenty to reflect on there and even some possible conclusions to come out of them.”

This report is based on the transcript of the session which can be read here. Please note that this is an uncorrected transcript and neither peers nor witnesses have at the time of writing had the opportunity to correct the record so it may be subject to change. The drafting of this report was assisted by Microsoft Co-Pilot but it has been checked, edited and added to by CIOT's External Relations Team.