CIOT survey into HMRC’s service levels

During late July and early August 2023, CIOT carried out a survey to obtain feedback on HMRC’s service levels. 760 responses were received. Thank you to all those who responded.

The headline results can be viewed in the press release from CIOT President Gary Ashford here.

What follows below are the questions and answers from the survey, a summary of the various results including respondents’ comments, and observations on what the responses tell us.

Response population

Summary of responses

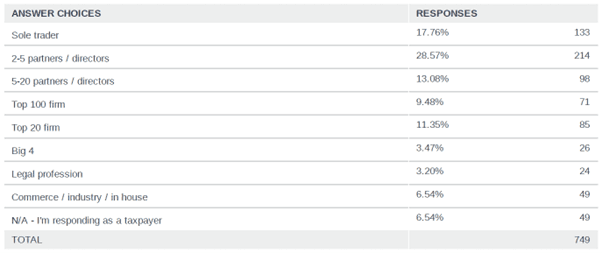

651 responses were received from agents, representing around 86% of total responses. Around one in five agents responding are sole traders, and around on in three are from two to five partner / director practices.

98 responses were received from HMRC’s ‘customers’, representing around 13% of total responses. These were split equally between those from commerce and industry, and from individual taxpayers. 11 respondents skipped the question.

Survey questions and answers

Q1 What best describes your agent practice? [select one]

What does the survey tell us?

The results of the survey will predominantly reflect the feedback of smaller agents, who make up nearly half of the total responses.

Note that the survey results quoted below are based on the entire response population. However, where appropriate, we have highlighted ratings from taxpayers and / or agents as a single group.

Contacting HMRC

Summary of responses

Agent Dedicated Line

This section represents the responses of agents only, and so the figures quoted may differ slightly from the full results reproduced below.

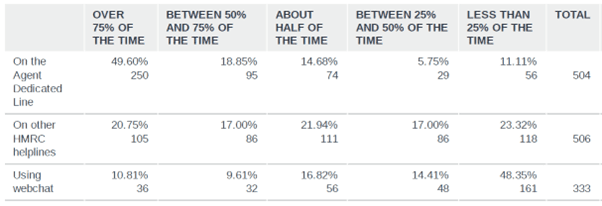

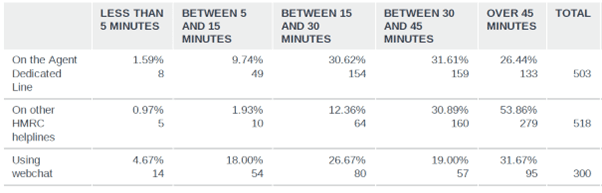

Over half of callers get through to an HMRC adviser at least 75% of the time, though average wait times can be long. Nearly a third wait 15-30 minutes, and another third 30-45 minutes, with around a quarter of agents having to wait over 45 minutes.

“Getting through is a min of 20 mins, if you can wait an hour you will get through.” [agent]

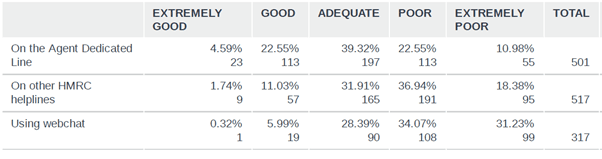

Once through to an HMRC adviser, nearly 40% of agents rated the service ‘adequate’, and about 24% rated it ‘good’, but a similar percentage also rated it ‘poor’.

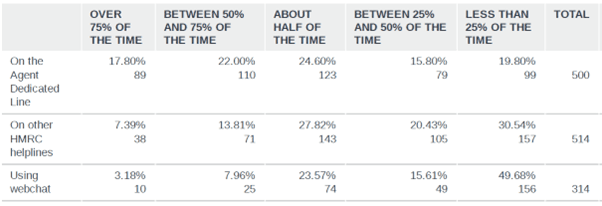

However, the ‘success’ of those calls varied. Less than one in five agents said that it enabled the cause of the contact to be resolved at least 75% of the time, with slightly more saying between 50% and 75% of the time, and a quarter saying about 50% of the time. One in six agents said calls to the ADL resolved their issue less than 25% of the time.

“Service by advisers on ADL is extremely variable - often very poor and incorrect information given to issues. Other times (and this is very much a rarity now) it can be very helpful indeed.” [agent]

“Some are helpful but others lack knowledge and don't seem to understand the query.” [agent]

Other HMRC helplines

Only one in five callers get through to HMRC at least 75% of the times they try, with nearly a quarter getting through less than 25% of the time. Over half of respondents reported an average wait time of over 45 minutes, with nearly a third saying between 30 and 45 minutes. Less than 1% reported getting through to an adviser in less than 5 minutes.

“I hate it when I sit for 35 minutes, do the security questions, then get cut off.” [taxpayer]

Satisfaction levels were mixed, with just under a third rating the service as ‘adequate’, but over a third rating it ‘poor’. Of the remainder, more rated the service as ‘extremely poor’ compared to ‘good’ or ‘extremely good’ combined.

Calls to these helplines were less successful than the ADL. 28% said it enabled the cause of the content to be resolved about 50% of the time, and one in five said between 25% and 50% of the time. Nearly a third of respondents said the helplines resolved their issue less than 25% of the time, and just 7% said resolution was obtained more than 75% of the time.

“They appear to be as helpful as possible on the phone but often tell you the problem has to be escalated so don't solve anything.” [agent]

Webchat

Webchat results were generally worse than those for the phone lines, although response levels and freeform comments suggest that webchat is not widely used. Nearly half of those using webchat reached an adviser less than 25% of the time, with only just over one in ten getting through to an adviser more than 75% of the time. Wait times varied, with nearly a third saying it takes over 45 minutes on average to get through to an adviser, and less than a quarter reporting that it takes less than 15 minutes.

Satisfaction rates for webchat were low. Only 6% of respondents rated it as either ‘good’ or ‘extremely good’, with 28% rating it ‘adequate’, 34% ‘poor’ and 31% ‘extremely poor’. This is perhaps unsurprising as nearly half of respondents said webchat resolved their issue less than 25% of the time, and around a quarter said it resolved their issue about 50% of the time. Only 3% said it resolved their issues over 75% of the time.

“Self assessment webchat helpful. But NIC webchat is poor.” [agent]

“Webchat advisers try their best to redirect you to phone lines in most instances. Service is horribly slow also.” [agent]

Survey questions and answers

Q2 How often, when contacting HMRC, do you get through to an HMRC adviser?

Q3 How long does it take to get through to an HMRC adviser?

Q4 When you get through to an HMRC adviser, how would you rate the service you receive?

Q5 How often does this contact with HMRC enable you to deal with the underlying cause for the contact?

What does the survey tell us?

We are well aware of call wait times from HMRC’s performance reports, although the above results suggest that our respondents experienced longer wait times than those reported by HMRC. But two important conclusions can be drawn from these results.

First, HMRC advisers (both on the ADL and general helplines) need to be better equipped to deal with the issues they face, to ensure that a greater number of calls can be dealt with successfully at a single attempt. HMRC refer to this as ‘once and done’, and statistics for phone, webchat and digital services are published in their monthly and quarterly performance updates. Recent performance is reported as circa 80%, which seems high when compared to the above results, although may reflect high levels of digital interactions.

Secondly, awareness of the webchat service, and its functionality, needs to be significantly improved, if it is to become a viable alternative to telephone contact, particularly as the responses from taxpayers themselves were less favourable than those from agents.

Alternatives to contacting HMRC

Summary of responses

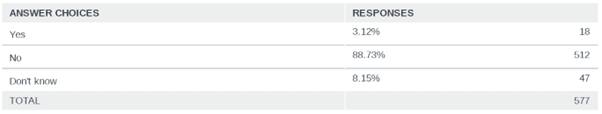

89% of respondents said the reason for their contact could not have been resolved using HMRC’s online services or third-party software (representing 90% of agents responding, and 79% of taxpayers).

“Too many forms can't be submitted online by agents, e.g. P87, SA401, CA4361.” [agent]

“Information required not available online.” [agent]

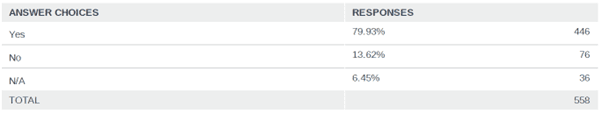

If it would resolve the cause for the contact, 80% would use HMRC’s online services or third-party software (representing 81% of agents responding, and 68% of taxpayers).

“If it was possible to solve the issue online, I would. Nobody wants to waste their life trying to phone HMRC.” [agent]

“I only call when online services have not resolved my query - so as a last resort.” [taxpayer]

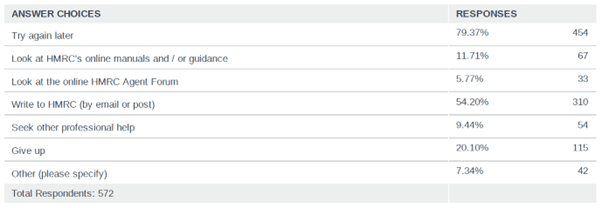

When unable to get through to HMRC, 79% said they would try again later and 54% would write to HMRC. Only 12% would look online. One in five people would ‘give up’, with that proportion being nearly one in three for the taxpayers who responded.

“Try and try again until we get through!” [agent]

“I give up after 15 minutes and write instead.” [agent]

Survey questions and answers

Q6 Generally speaking, could the cause for the contact have been resolved using HMRC’s online services (or third-party software)?

Q7 Where the answer to Q6 is no, generally speaking would you use HMRC’s online services (or third-party software) if they would resolve the cause for the contact?

Q8 When you are unable to get through to an HMRC adviser, what do you normally do? [select all that apply]

What does the survey tell us?

The vast majority of contact with HMRC is for matters which cannot be resolved digitally, yet most respondents would be willing to interact digitally if it could resolve their issue. While there will always be a need to provide non-digital channels such as telephone, HMRC should prioritise digitalising the high volume / resource intensive processes which currently require personal interaction, while ensuring that existing digital processes are working as planned.

It also demonstrates that most people will simply try calling later or will write to HMRC – creating further (and potentially more time-consuming) contact with HMRC. It is also concerning that nearly one third of taxpayers would consider giving up if they didn’t get through to an HMRC adviser, potentially falling into non-compliance.

Dealing with HMRC digitally

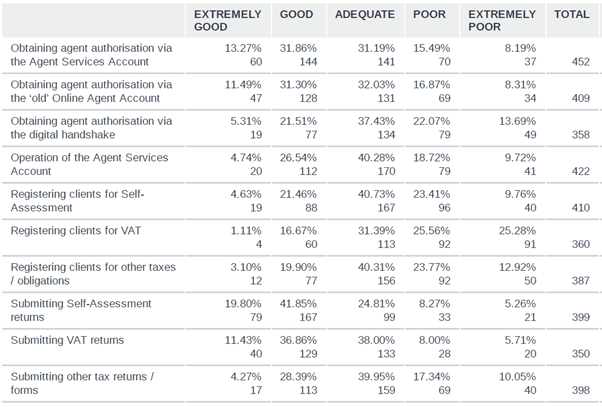

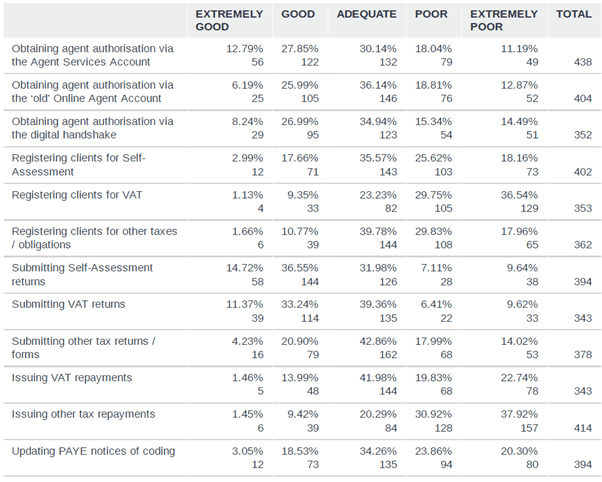

Summary of responses

The majority of respondents rated their experience of using HMRC’s online services to undertake tasks as ‘good’ or ‘adequate’, with the notable exception of the new VAT registration service, where over half rated it as ‘poor’ or ‘extremely poor’.

“VAT registration - the new online form is not user friendly when printed/saved to pdf (we send pdf to clients for approval prior to submission etc). The old format was much better. Also, the new online application is frustrating because every time you go into it to add/change info, you have to re-enter a lot of information.” [agent]

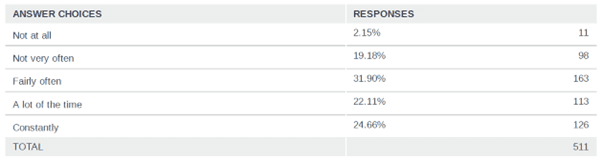

Speed of processing digital tasks was also generally considered acceptable; more so where the action within HMRC is automated. Again, the new VAT registration service received poorer ratings, as well as registering for Self-Assessment and other taxes. These elements are likely to have contributed to the need to chase HMRC, with a quarter of respondents having to ‘constantly’ chase HMRC for something submitted online, with over one in five people chasing ‘a lot of the time’.

“Some VAT registration applications are processed quickly (within two weeks) and others take months, even when they are for quite straight forward businesses.” [agent]

“Generally SA repayments are very quick, but when delayed it is impossible to get them out (particularly estates).” [agent]

“Constant referrals being made with response dates however the response date comes along and no action has taken place.” [agent]

Survey questions and answers

Q9 How would you rate your experience of undertaking the following tasks completed via HMRC’s online services?

Q10 How would you rate HMRC's speed of processing the following tasks completed via HMRC’s online services?

Q11 How often (if at all) have you needed to contact HMRC to chase up something you have submitted online? [select one]

What does the survey tell us?

‘Tried and tested’ digital services are generally considered acceptable, particularly where the process is one-way ie the submission of a return to HMRC, although these are not entirely trouble free. However, digital services can be problematic in two main areas.

First, when they are introduced with inadequate testing, and inferior functionality to that which it replaces. The new VAT registration service suffered from both these failures, and the survey results reflect that. We have developed a set of minimum standards that we believe HMRC should follow when implementing new digital systems.

Secondly, when the process is not entirely automated and manual intervention is required, this can lead to delays and chaser calls to HMRC. This could be reduced through better guidance on the types of issue / error which prevent automation, and the steps which can be taken to eliminate them.

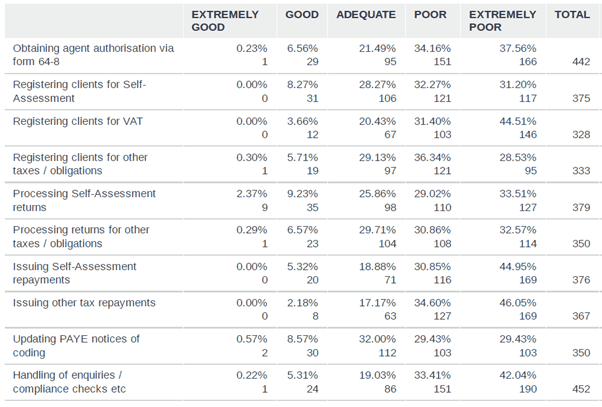

Dealing with HMRC by post

Summary of responses

There was overwhelming dissatisfaction with HMRC’s postal performance. In all cases, more than half of respondents (and in some cases, more than three quarters) rated HMRC’s speed of processing as ‘poor’ or ‘extremely poor’. HMRC didn’t achieve double-digit results in either ‘good’ or ‘extremely good’.

“Things take so long to be answered and you don't know they have been received.” [taxpayer]

“When I write to HMRC or send a form, I genuinely do not expect a response or for the form to be processed within 6 months. Appalling and shocking level of service from HMRC where any form of paper is concerned.” [agent]

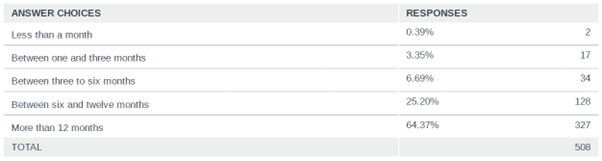

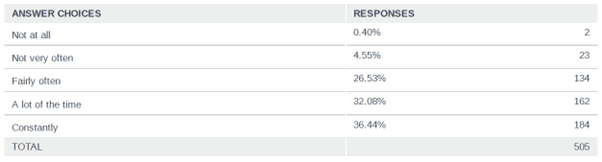

Nearly two thirds of respondents have waited over a year for a reply to correspondence sent by HMRC, with over a third saying that they chase HMRC ‘constantly’, and just under a third chasing ‘a lot of the time’.

“I would say that 90% of the time it is necessary to chase. HMRC can take weeks and months but the final insult is usually that after a wait of weeks or months the response received usual contains a request that the taxpayer responds within X days. HMRC is the ultimate example of demanding that tax payers maintain standards that it would never expect to apply to itself.” [agent]

Survey questions and answers

Q12 How would you rate HMRC's speed of processing the following tasks completed by post?

Q13 Approximately, what is the longest period of time you have had to wait for a reply to correspondence sent to HMRC? [select one]

Q14 How often (if at all) have you needed to contact HMRC to chase up correspondence submitted to them? [select one]

What does the survey tell us?

Again, we are well aware of call wait times from HMRC’s performance reports, and HMRC has recently launched a task force to deal with post over a year old.

As previous results illustrate, where processes can be undertaken digitally, and automated, processing times and satisfaction levels are higher. HMRC should continue to focus on removing barriers to automation, to increase the level of digital interaction. As also identified above, significant levels of correspondence are created because of the inability to deal with the matter by phone or webchat, and so improving ‘once and done’ when contacting HMRC will reduce written contact. The HMRC service dashboard and ‘Check when you can expect a reply from HMRC’ tools should also be enhanced so that taxpayers and agents can trace individual items of correspondence and see target dates specific to their circumstances.

HMRC errors

Summary of responses

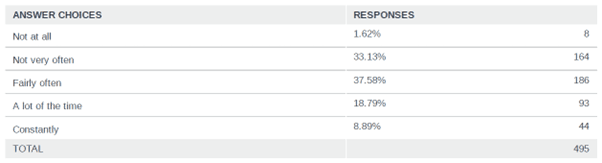

There was a mixed response to the frequency with which respondents had to contact HMRC to correct errors which HMRC had made. Around one third said this was ‘not very often’, and over a third ‘fairly often’. Less than 2% reported not having to contact HMRC about this at all, though 9% have to do this ‘constantly’.

“P800 and SA systems do not tally. P800 often misses income which they never request eg dividends. PAYE code numbers often carry forward old items which are obviously wrong when the original source is long gone.” [agent]

“Completely messed up my mother's probate affairs.” [taxpayer]

Survey questions and answers

Q15 How often (if at all) do you have to contact HMRC to correct errors they have made / introduced into your / your clients’ tax affairs? [select one]

What does the survey tell us?

While the results do not evidence an overwhelming level of HMRC errors, it is clear that sufficient errors are being made / introduced by HMRC, which leads to avoidable contact and unnecessary costs. The cause of these errors should be identified and, ideally, resolved. However, in the meantime, guidance should be provided to help prevent these errors occurring, in the form of workarounds or guidance. For example, issues involving the marriage allowance can be avoided if the transferor’s Self-Assessment return is filed 72 hours before the transferee’s. Similarly, assumptions or rules applied by HMRC should be more clearly explained, such as regarding the carry-forward of allowances in tax codes.

Quality of HMRC products

Summary of responses

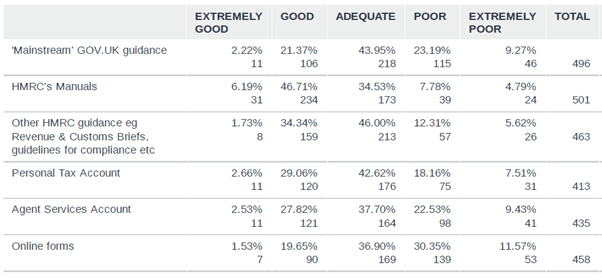

Most HMRC products were predominantly rated ‘adequate’, with HMRC’s manuals mainly being considered ‘good’. Over 40% of respondents rated HMRC’s online forms as ‘poor’ or ‘extremely poor’.

“Some of the new Gov.uk VAT guidance is too basic / too dumbed down and does not provide full details; could easily lead to lay-people could making mistakes.” [agent]

“I have opted for right down the middle due to the extreme variability in performance. Sometimes the guidance can be pretty good and other times, woeful or even incorrect.” [agent]

“Some forms can be completed then saved and reopened to make changes, some once saved cannot be amended at all so a new form is needed. Some can only be completed one page at a time so it is impossible to identify all the information needed to complete it and as it cannot be saved and reopened to continue it has to be restarted from scratch. Some don't have facility to add additional comments and/ or documents.” [agent]

Survey questions and answers

Q16 Generally speaking, how would you rate the quality of the following HMRC products?

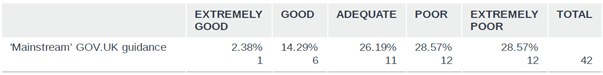

Note - taxpayer-only response:

What does the survey tell us?

Looking behind the above numbers, as illustrated above, taxpayers’ feedback on ‘mainstream’ GOV.UK guidance was significantly worse than that from agents, with well over half rating it either ‘poor’ or ‘extremely poor’ (compared to 30% of agents). This suggests that this guidance is not fulfilling taxpayers’ needs, and hence may be a cause of the high levels of HMRC contact. We would recommend further research be carried out into the effectiveness of HMRC’s mainstream guidance. Conversely, HMRC’s manuals received strong ratings, largely due to the increased level of detail provided therein, and the high proportion of agents responding to the survey.

The poor rating of HMRC’s online forms was largely driven by the inability to see the whole form and its information requirements prior to completion. This is something we have previously challenged, and we have set out the minimum functionality we consider is needed for HMRC’s digital forms.

Impact of HMRC’s service levels

Summary of responses

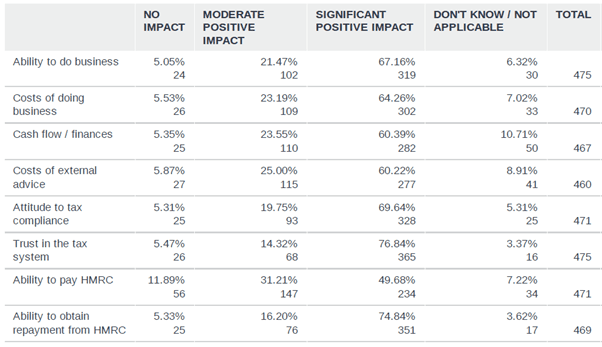

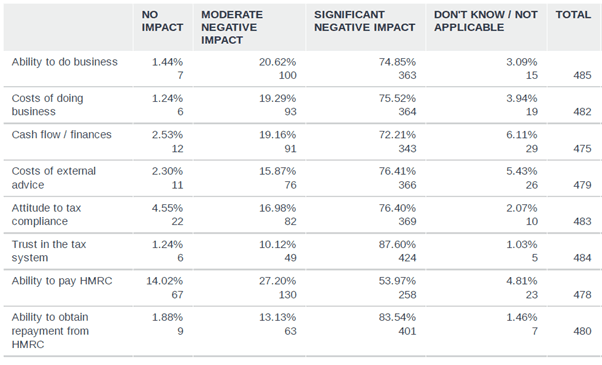

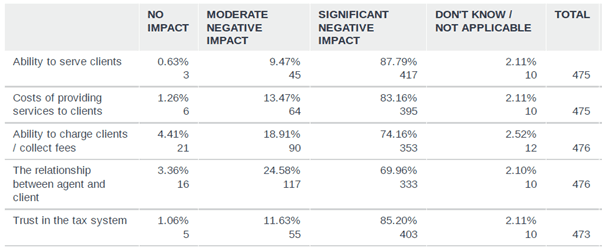

The majority (a significant majority in some cases) thought good HMRC service levels have a significant positive impact on critical factors such as the ability to do business, the costs of doing business, attitudes to tax compliance and trust in the tax system, to highlight just a few. Conversely, a greater majority thought poor HMRC service levels have a significant negative impact in those areas.

“Good services cut the amount of time and costs for everything and reduce stress levels enormously, for agents and taxpayers alike.” [agent]

“Massive negative impact on agents and taxpayers, costs and cashflows.” [agent]

“Poor service levels make HMRC appear very incompetent and cost clients money because we charge for sorting the mess out/chasing HMRC etc. Also cashflow is adversely affected if for example a business has to wait months for a VAT registration number and therefore can't get a repayment of vat incurred on costs, or has an approved VAT repayment held by HMRC for no apparent reason.” [agent]

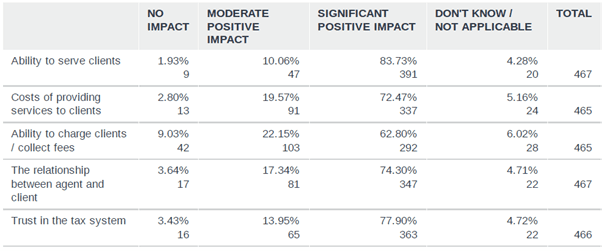

Similar impacts were reported by agents, with good HMRC service levels having a significant positive impact on their ability to service clients, the costs to themselves and clients, and trust in the tax system. Again, a greater majority thought poor HMRC service levels have a significant negative impact in those areas.

“We are having to charge additional fees for our time trying to chase up on matters and dealing with complaints from clients that we are unable to resolve due to HMRC delays.” [agent]

“It’s very hard to charge a client for chasing HMRC for a response monthly for a year!” [agent]

“It is so depressingly bad I no longer want to come to work.” [agent]

Survey questions and answers

Q17 What impact (if any) do GOOD HMRC’s service levels have on businesses and taxpayers?

Q18 What impact (if any) do POOR HMRC’s service levels have on businesses and taxpayers?

Q19 What impact (if any) do GOOD HMRC’s service levels have on agents?

Q20 What impact (if any) do POOR HMRC’s service levels have on agents?

What does the survey tell us?

The survey shows that HMRC’s service levels have a significant impact on businesses, taxpayers, and the ‘health’ of the tax system. It demonstrates that investment in HMRC benefits the economy as a whole, not just the tax system.

There is also a worrying theme about the impact on agents’ businesses and general mental health. The tax system relies on a thriving, healthy intermediary market, and we are concerned that the future of this market is being endangered by HMRC’s service levels.

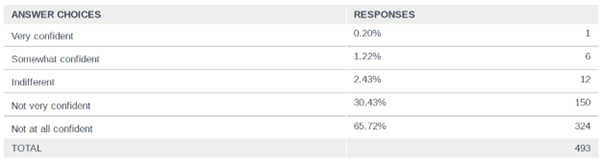

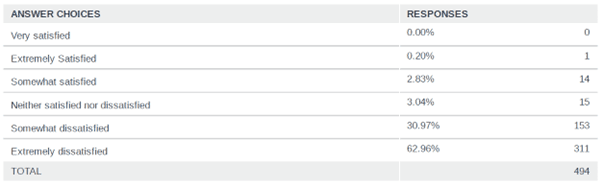

Overall satisfaction, and looking ahead

Summary of responses

Nearly two thirds of respondents were ‘not at all confident’ that HMRC’s services levels will significantly improve over the next 12 months, with nearly one third ‘not very confident’. Only one, single respondent was ‘very confident’ of a significant improvement.

“The level of service is so poor they have a long way to go.” [taxpayer]

“Poor leadership, inadequate staff, poorly trained.” [taxpayer]

“The service has been so poor for so long, HMRC seem to think it is acceptable. It is not the actual staff, they are doing their best, it is the lack of staff.” [agent]

“Absolutely no chance - they need more people/investment which the government will not give them.” [agent]

Nearly two thirds or respondents were ‘extremely dissatisfied’ with the service provided by HMRC, and just under one third ‘somewhat dissatisfied’. Only a single respondent was ‘extremely satisfied’. We received 159 freeform comments alongside the ratings to the final question. The following comments seem representative of the overall feedback:

“HMRC ignore correspondence, ignore complaints made via the complaints system, when I do get through advice is plain wrong. HMRC are quick to penalise taxpayers when taxpayers are late but there is no obvious comeback for their appalling service.” [taxpayer]

“HMRC have double standards. They expect agents and taxpayers so stick to tight timescales and are quick to issue penalties. However, they overlook their own shortcomings and are shockingly unaware of the damage they have on the mental and physical health of agents and tax payers alike. HMRC service levels for VAT registration is particularly appalling and has detrimentally impacted a number of our clients.” [agent]

“The very slow response from HMRC and lack of ability to speak to anyone with sound knowledge has a very negative impact on HMRC's reputation both for us as agents and taxpayers. It has a significant impact on the amount of trust the tax payer has in the HMRC and its ability to do its job. There are small pockets of HMRC that work well (the more specialised areas where the inspectors have a greater understanding of tax and therefore easier to get things sorted) but this seems to be getting smaller as time goes by.” [agent]

Survey questions and answers

Q21 How confident are you that HMRC’s service levels will significantly improve over the next 12 months?

Q22 Overall, how satisfied are you with the service provided by HMRC?

What does the survey tell us?

Here the results speak for themselves. Respondents reported widespread dissatisfaction with the service provided by HMRC, and little confidence of any improvement.

We will be sharing and discussing these results with HMRC, and we will continue to work with them and suggest measures to improve their service levels.