CGT on property 30-day reporting issues – process for offset of CGT overpayment

As reported last month, the CIOT and other professional bodies met HMRC recently to try to resolve outstanding issues with the CGT 30 days reporting service. One such current issue is how HMRC’s systems deal with the interaction of the CGT 30-day return and the self-assessment return where there has been an overpayment of CGT that is available for set-off against an income tax liability in accordance with TMA 1970 section 59B.

HMRC have provided details, as reproduced below, of an interim process for dealing with an overpayment of CGT:

Offset of UK Property Disposal Capital Gains Tax

- After submitting an in-year UK Property Disposals return, if the user needs to amend their return, they can do so via the UK Property Disposals return service or via their Self Assessment tax return.

- If they amend via the UK Property Disposals return service, and their liability reduces, they can claim a repayment via the service. This will then be processed by HMRC.

- If the user chooses to amend via Self Assessment, they should complete the Self Assessment tax return with their overall Capital Gains Tax (CGT) residential property gains and the total gains or losses and tax charged via the UK Property Disposals return service.

- After all relevant sections of the Self Assessment tax return are completed, the user should go to view the calculation section and tick the option to View and print your full calculation.

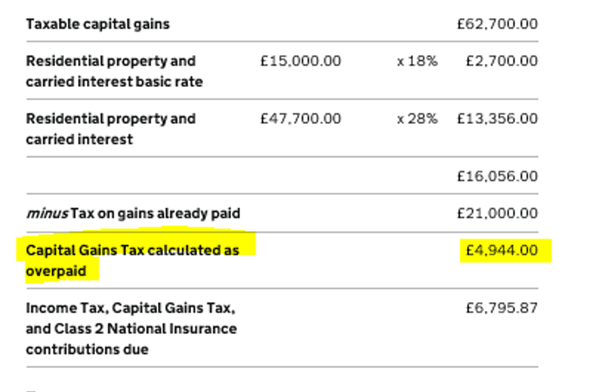

Example output below:

- The user can then pay the difference between the Income Tax, CGT and Class 2 NICs due figure and the CGT calculated as overpaid figure. In the example above £6,795.87 - £4,944.00 = £1,851.87. Please note that the Self Assessment payment deadline is the 31 January following the tax year.

- The user should then contact HMRC by telephone on 0300 200 3300 to enable HMRC to make a manual adjustment. If any further action is required by the user HMRC will contact them to advise what that is.

- If the user chooses to make payment in full of the Income Tax, CGT and Class 2 NICs figure (£6,795.87), they should contact HMRC to request a repayment of their overpayment. This will then be reviewed by HMRC.

- Once the Self Assessment tax return has been submitted, the user should not attempt to amend their UK Property Disposals return for the corresponding tax year.

This interim process will be communicated further by HMRC via the agent forum and via GOV.UK. HMRC recognise this interim process requires an additional step in the need to contact HMRC following submission of the self-assessment return and will be working to explore a more satisfactory solution for the longer term.