Find out more

CA CTA Joint Programme 2026+

The CA CTA Joint Programme is changing. The changes aim to develop students’ knowledge through two stages of academic level progression to support success in the final Advanced stage CTA exam. The study routes offered align to the proposed new CTA structure, to be examined from 2028 which means we have future proofed the Joint Programme with this in mind.

The CTA Syllabus is being updated to provide a smoother transition to the Advanced Technical or Application and Professional Skills paper by introducing a new Level 6 equivalent Tax Knowledge and Skills paper. Making these changes has allowed us to closely re-examine the syllabi of both qualifications side-by-side helping us to determine the best way to deliver an effective Joint Programme fit for the future.

Registrations for the revised programme, CA CTA Joint Programme 2026+, will open in Spring 2026. Transitional rules will apply to existing Joint Programme students. These are explained on our FAQs pages for both the previous Joint Programme and the 2026+ Joint Programme.

By completing the CA CTA Joint Programme 2026+, you could become an ICAS Chartered Accountant and a Chartered Tax Adviser in four years, depending on how you pace your studies. You will also need to meet the relevant practical experience requirements for each organisation.

Key benefits of the CA CTA Joint Programme 2026+

- Achieve two prestigious qualifications: the CA and CTA whilst maintaining rigorous standards of the ICAS and CIOT

- Streamlined learning provides an efficient, fast-track route to professional development in taxation and accountancy

- Greater academic level progression through the introduction of the CTA Tax Knowledge and Skills paper

- Delivers breadth and depth of tax knowledge plus skills including understanding the tax landscape, ethical practice and impact of technology on the profession.

Find out more about key changes to the CTA Joint Programmes

Qualification Structure

In total, there are 15 assessments in the CA CTA Joint programme 2026+. The full qualification structure is shown in our CA CTA Joint Programme summary document.

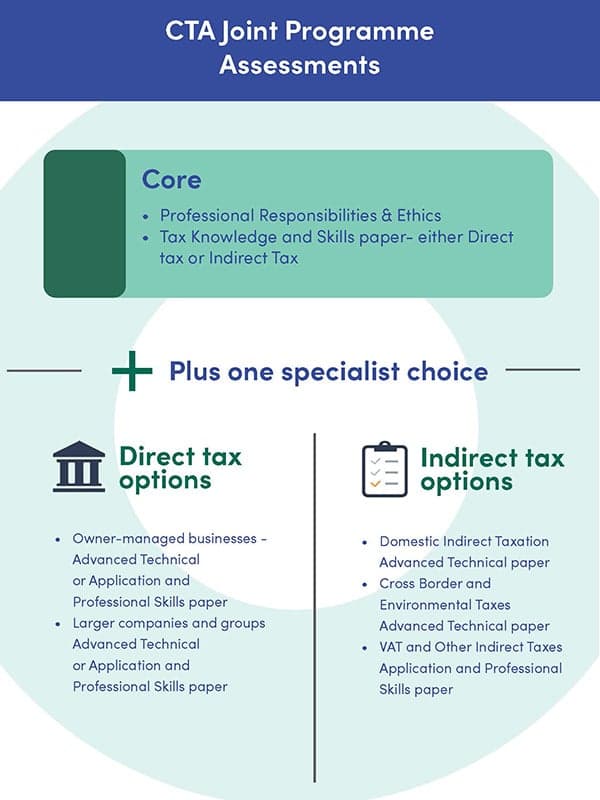

All students will be required to undertake the following CTA specific papers as part of the Joint Programme:

- CTA Professional Responsibilities and Ethics,

- CTA Tax Knowledge and Skills – choosing either Direct or Indirect Tax option,

- and one CTA Advanced level paper, either an Advanced Technical or Application and Professional Skills paper from a selection of papers available under the Joint Programme.

Tax Specialism

You’ll have the opportunity to specialise in one of three areas of taxation:

- Larger Companies and Groups

- Owner-Managed Businesses

- Indirect Tax

How can I find out more about this programme?

See the CA CTA Joint Programme 2026+ FAQs

If we haven't answered your question please contact the CIOT Education team at: [email protected]