"We need tax competition and tax havens so politicians are discouraged from trying to solve a spending problem with higher taxes"

In a guest blog for our website, Dan Mitchell, co-founder of the Center for Freedom and Prosperity, expands on comments he made in a recent BBC World Service The Real Story podcast in which he made a case for tax havens. Dan Mitchell is a public policy economist in Washington DC.

(The BBC podcast can be found on this link)

Politicians in high-tax nations routinely vilify so-called tax havens. They argue that these low-tax jurisdictions are rogue regimes that don’t play by the rules and thus cause economic instability.

And now the political attacks are intensifying because governments are especially anxious to grab more revenue in order to finance an ever-expanding burden of government spending.

Since I consider myself the world’s biggest advocate for tax competition and tax havens (even when it’s risky), I want to present an alternative view.

Sadly, my support for tax havens is not because I have lots of wealth to protect. Instead, I’m motivated by a desire to protect the world from “goldfish government.”

To elaborate, politicians have a “public choice” incentive to enact ever-growing government, even if they actually understand such policies almost surely will lead to Greek-style fiscal collapse.

To guard against this unpalatable result, we need some sort of external constraint to keep governments from over-taxing and over-spending. And that’s why the world needs tax havens.

Simply stated, when politicians worry that the “geese with the golden eggs” can escape – thanks to tax havens – they are much more likely to adopt good tax policy (or, to be more accurate, they’ll be less likely to impose bad tax policy).

Indeed, that is exactly what we saw during the golden age of tax competition between 1980 and 2007. Average top personal tax rates in the industrialized world dropped from nearly 70 percent down to about 40 percent and average corporate tax rates plunged from nearly 50 percent down to less than 25 percent.

These pro-growth changes didn’t occur because politicians were reading my policy studies. They happened because government officials were afraid that they would lose jobs and investment if they kept punitive tax rates while other jurisdiction adopted reasonable tax rates.

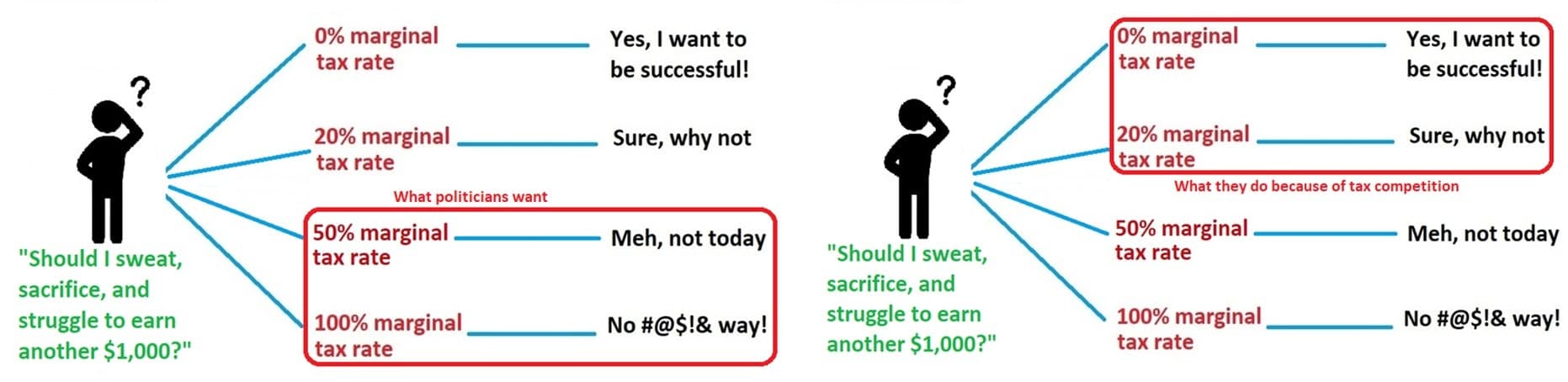

Here’s a visual I often use when giving speeches around the world on this issue. It shows the impact of tax rates on incentives to be productive – and also shows the tax rates politicians want (on the left) compared to the tax rates that are actually imposed (on the right) when there is effective tax competition.

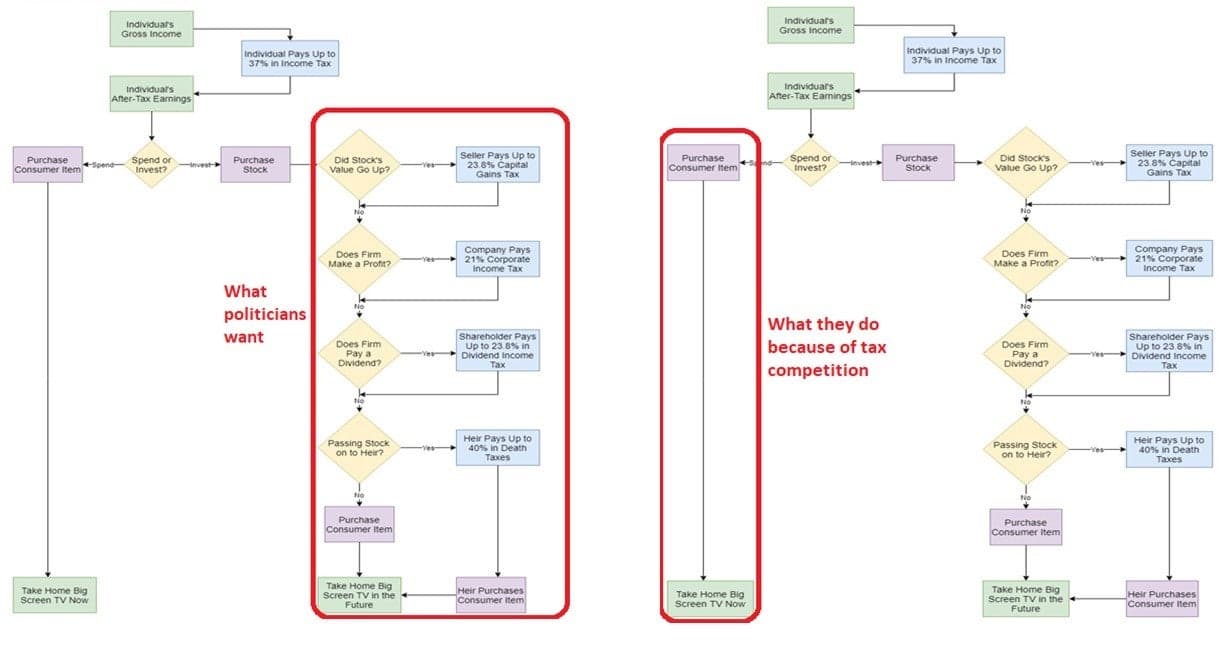

Without pressure from tax havens, governments also tend to impose very destructive tax rates on interest, dividends, and capital gains. They even sometimes augment those forms of double taxation with death taxes or wealth taxes, thus creating triple taxation.

But those tax rates also have plummeted in recent decades thanks to tax competition and tax havens.

Here’s a visual (based on U.S. tax rates) to show how tax competition discourages politicians from over-taxing saving and investment.

In the real world, of course, the data can get messy. Some nations have low tax rates for some types of economic activity and high tax rates for others. Some countries have lowered tax rates slightly and some have lower tax rates a lot.

What matters, though, is that lower tax rates are desirable and tax havens and tax competition make those good policies more likely.

Needless to say, there are people who disagree with me.

Some of them (I’m not joking) even urge military action against low-tax jurisdictions.

But the more serious folks on the left try to make economic arguments.

In part, they claim that high tax rates aren’t terribly destructive. Though that’s a difficult argument since even research from left-leaning multilateral bureaucracies such as the International Monetary Fund and Organization for Economic Cooperation and Development confirms such policies lead to significant economic damage.

So the main argument they make is that tax competitions causes a misallocation of resources.

In a July 2013 article for Cayman Financial Review, I explained (fairly, I think) this theory.

…there also has been a strain of academic thought hostile to tax competition. It’s called “capital export neutrality” and advocates of the “CEN” approach assert that tax competition creates damaging economic distortions. They start with the theoretical assumption of a world with no taxes. They then hypothesize, quite plausibly, that people will allocate resources in that world in ways that maximise economic output. They then introduce “real world” considerations to the theory, such as the existence of different jurisdictions with different tax rates. In this more plausible world, advocates of CEN argue that the existence of different tax rates will lead some taxpayers to allocate at least some resources for tax considerations rather than based on the underlying economic merit of various options. In other words, people make less efficient choices in a world with multiple tax regimes when compared to the hypothetical world with no taxes. To maximise economic efficiency, CEN proponents believe taxpayers should face the same tax rates, regardless of where they work, save, shop or invest. …One of the remarkable implications of capital export neutrality is that tax avoidance and tax evasion are equally undesirable. Indeed, the theory is based on the notion that all forms of tax planning are harmful and presumably should be eliminated.

And I then explained why I think the CEN theory is highly unrealistic.

…the CEN is flawed for reasons completely independent from preferences about the size of government. Critics point out that capital export neutrality is based on several highly implausible assumptions. The CEN model, for instance, assumes that taxes are exogenous – meaning that they are independently determined. Yet the real-world experience of tax competition shows that tax rates are very dependent on what is happening in other jurisdictions. Another glaring mistake is the assumption that the global stock of capital is fixed – and, more specifically, the assumption that the capital stock is independent of the tax treatment of saving and investment. Needless to say, these are remarkably unrealistic conditions.

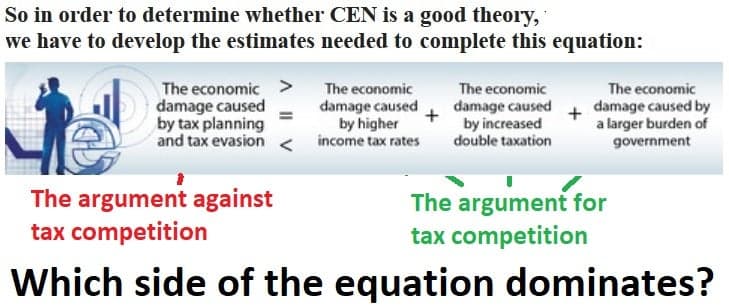

Here's a visual I often use when presenting this concept to audiences who care about these issues.

The bottom line is that the potential economic inefficiency caused by tax planning (the left side of the equation) is trivial compared to economic inefficiency caused by high tax rates, punitive double taxation, and a more burdensome public sector (the right side of the equation).

Let’s conclude with the observation that the battle over tax havens and tax competition is actually a proxy for a bigger fight about the future of the welfare state.

Politicians in most developed nations have enacted wide-ranging redistribution and social-insurance programs. These programs were mathematically feasible (though economically undesirable) when they were first created because there were lots of workers and relatively few beneficiaries.

But now that birthrates have declined and the post-World War II generation of baby boomers is beginning the retire, politicians have suddenly realized that there won’t be enough taxpayers to finance all the promised benefits.

Of course, all the coronavirus-related spending makes a bad fiscal outlook even worse.

This leaves politicians with three options:

- Keep spending and spending (and borrowing and borrowing) until there’s a Greek-style debt crisis.

- Reform entitlement programs so they are demographically sustainable.

- Figure out ways to extract more tax revenue from the economy’s productive sector.

No legislators overtly support option #1. So let’s consider the other two choices.

The main thing to understand is that politicians have little incentive to control spending and reform programs (option #2) if they think they can grab more money (option #3).

Yet big tax increases not only are economically destructive, they also won’t stabilize government finances so long as government spending grows faster than the private sector.

Most politicians will resist, but the only sensible answer is to limit the growth of government.

Which is why we need tax competition and tax havens so politicians are discouraged from trying to solve a spending problem with higher taxes.

To conclude, tax competition is a necessary but not sufficient condition to promote good policy. And that’s why I’m willing to defend tax havens, even if it requires bringing a message of liberty to traditionally hostile audiences such as readers of the New York Times and viewers of CNN.

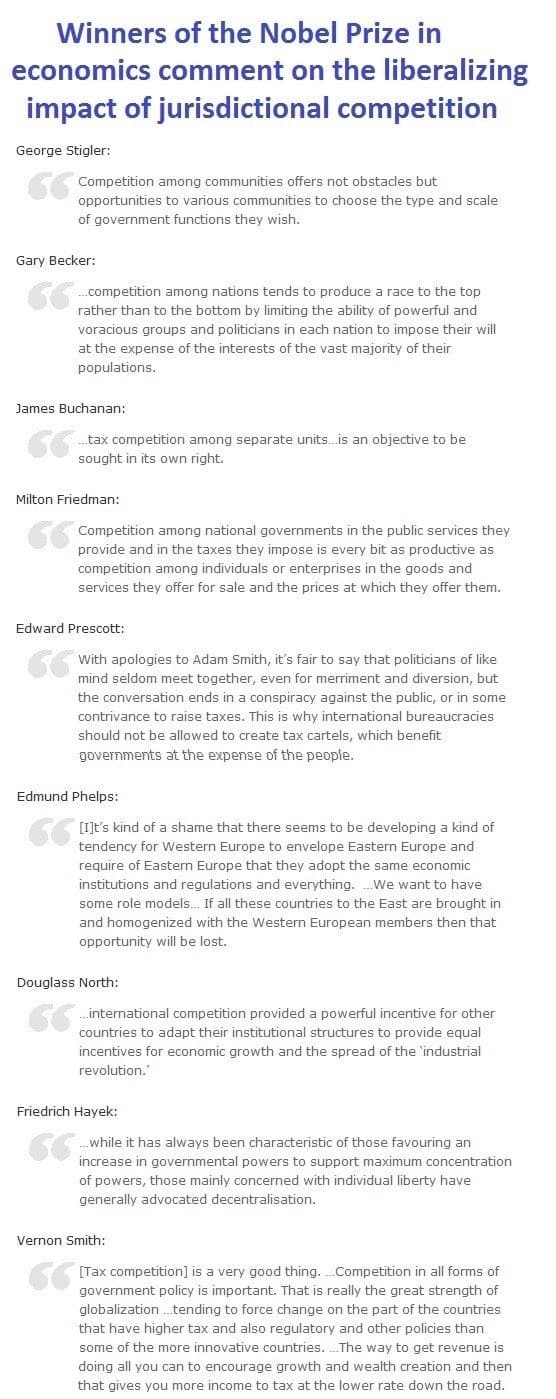

P.S. Here’s an appeal to authority on the issue of tax competition.

Guest blog by Dan Mitchell, co-founder of the Center for Freedom and Prosperity and Chairman of the Board. The Center for Freedom and Prosperity is a non-profit organisation created to advance market liberalisation. It is based in USA.

* The CIOT invites regularly people with a working interest in tax to write guest blogs for the CIOT website. If you have an opinion that you would like to share with tax professionals and journalists with an interest in tax who visit our website, in a blog format, contact Hamant Verma ([email protected]). Note that guest blogs do not necessarily reflect the views of the CIOT. We are interested in blogs that help the CIOT website to be a forum for debate about tax.